Trading Lessons

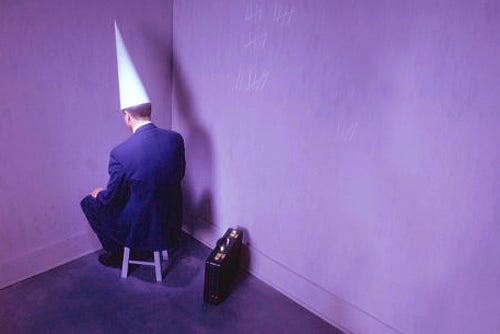

Image source: https://dmaxlaw.com/

I posted a version of this on X and it was popular so I decided to share it over here too.

A recent personal trading experience with lessons for anyone interested.

My discretionary trading hasn’t been so hot this month. I’ve mostly waited for my setups and taken positions when they came but, for whatever reason (it wasn’t a lack of paying attention to the calendar), as soon as I got in my stocks reversed hard on no news and stopped me out. While I know no one is “out to get me”, it is easy to feel like the anonymous “they” are secretly conspiring against me.

For the most part, I have been doing the “right” things in terms of process but have been getting bad results which, unfortunately, is part of the game. However, I did make one colossal rookie mistake (or set of mistakes) despite knowing better and, in sharing this, I hope to teach anyone interested a lesson at my expense. I will keep this anonymous to protect the innocent.

I saw (on X formerly Twitter) a trader whom I respect talking about a possible setup in a stock. His setups are not my setups but, motivated by the idea of branching out since I wasn’t seeing my setups (mistake/lesson #1: impatience led me to deviate from the “plan”), I decided to add this stock to my watch list.

Full disclosure, when this trader talks about his setups (which he finds from looking at charts) I don’t see them. As it relates to his setups, the charts speak to him in a language that I don’t understand. And his setups are definitely not my style of setup. But he is a better trader than I so I felt like emulating him (mistake/lesson #2: I should have stuck to my own process; trying to trade like another trader is almost always a recipe for bad outcomes).

To make matters worse, I didn’t actually wait for the setup related breakout. Concerned I might miss the move due to a gap (this is a jumpy stock), I decided to get in ahead of the breakout that didn’t come. Well, actually it did come but too late for me. I jumped in only to see the stock drop a ton the next day which caused me to dump it.

Side note, my saving grace as a trader is that I am great at taking losses. I don’t rationalize, I just get out which likely stems from too many years of rationalizing and getting smoked. I also really love getting rid of something that irritates me. We all have our own strengths and weaknesses as traders.

Regardless, this is the third major mistake/lesson, trying to anticipate a setup related breakout almost always ends with a sob story. Don’t anticipate, wait for the market to confirm.

As often happens, I sold pretty much the low only to watch the stock rebound into that day’s close and proceed to careen higher at breakneck pace while I sat on the sidelines licking my wounds. This ended up being my biggest loss all year (about 1.5% of my account) and, unlike losses that result from good process meeting bad outcomes, this one is entirely on me.

As I had hit my self-imposed maximum monthly loss % in aggregate, I liquidated everything and went to cash and then reviewed my crummy results to find out if the losses came from good process meets bad outcomes or bad process. Mostly it was good process meets bad outcomes outside of the trade outlined above (which was the worst loss).

But here’s the thing, I’ve traded for a long time, I study traders, I interview amazing traders all of which is a long way to say, in hindsight, I knew damn well not to do what I did. And yet, I did it.

In considering why, Livermore’s comments on being human and subject to human frailty as an explanation for why he did silly things he knew he shouldn’t do came to mind.

Hopefully sharing my knucklehead moves above will help you to avoid doing the same. And sharing this publicly will shame me into not doing it again!

On a positive note, my systematic strategies, with which I do not tinker as they are aligned with my goals, are doing terrific right now.

Finally, I should mention that I do not discretionarily trade for anyone but myself since I cannot always defend my actions which sometimes come from intuition. And clients of my money management business are allocated to systematic strategies which are aligned with specific goals and thus are not subject to my sometimes indefensible discretionary trading actions.

Brilliant. There are many ways to skin the cat

Appreciate the honesty, George. I feel for you. In my (limited) experience, it's a toin coss whether it's better to anticipate a breakout that looks like it's coming or to buy the breakout when it actually comes. I know that's close to heresy in trading circles. I do operate on weeklies, though, so that may explain the difference.