Thoughts on Paul Mulvaney

Image Source: trendfollowing.com

Like a lot of people in the trading world, I’ve been thinking about Paul Mulvaney lately. Mulvaney is a trend follower who doesn’t do much in the way of public relations but he sure is getting attention right now.

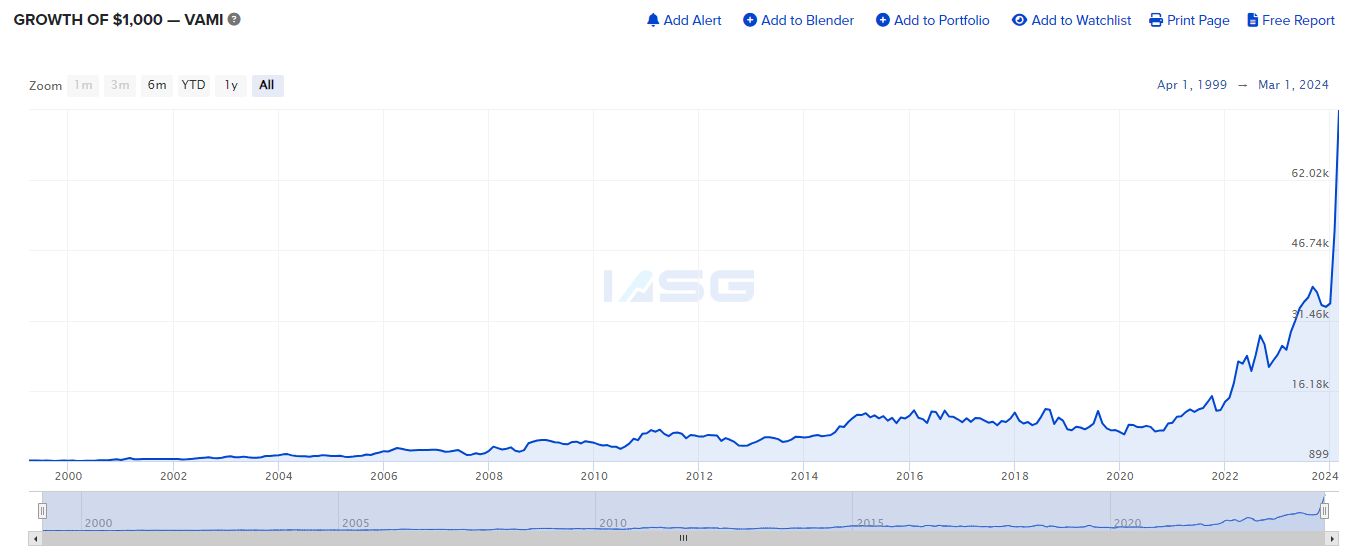

The main reason that Mulvaney is getting attention relates to his recent performance which is pretty darn enviable.

Source: IASG

In terms of his returns for the past few years: 2020 +18.52%, 2021 +32.93%, 2022 +89.44%, 2023 +51.23%, 2024 YTD +124.42%.

$7,600 invested with Mulvaney at the end of 2019 is now worth $77,000. He’s up ten fold.

The interesting thing about Mulvaney is that, according to his interview with Michael Covel, he has been doing the same thing for the past ~25 years. If you take Mulvaney at his word, and I see no reason to think he is lying, he’s been running the same trading system since day one.

Why does this matter?

It demonstrates a truth that I see more and more in my research: success tends to find those who stay consistent and keep doing the same thing(s) until “luck” shows up.

While Mulvaney wasn’t exactly a slouch prior to 2020, he certainly was not the household name (among traders) that he is now. Now he’s become a legend, a hero, a trader to marvel over. But he hasn’t changed. Let me digress…

I sometimes think of trading systems as fishing nets. There are different kinds of fishing nets. In the pet store, they have small nets designed to scoop little fish out of an aquarium. Alternatively, if you go fishing on a boat for game fish, the nets are larger and have a wider mesh that wouldn’t catch the small pet store fish.

My point here is that different nets are designed to capture different things just like different trading systems are designed to capture different things. Bringing it back to Mulvaney, the only thing that has changed is that the markets have aligned almost perfectly with his system’s design which has enabled his amazing performance.

Is this sustainable? Probably not

Will Mulvaney experience a nasty drawdown? Almost certainly

But, to me, the larger point is that, in Paul Mulvaney, we have another datapoint that supports the idea of staying consistent with one approach waiting for your style to catch fire. Of course, clarity on what you’re targeting (total return, Sharpe, etc.) and setting your leverage and such is important, but you get the point.

But the lessons from Mulvaney don’t stop there.

If you study trend following you will find out that what Mulvaney is doing isn’t exactly rocket science. Said another way, and subject to capital restrictions (aka if you have too much money you won’t be able to trade some of the smaller markets that Mulvaney does), I imagine most people who learned how to build a trend system and researched various public info on Mulvaney (here, Covel’s interview, etc.) could replicate Mulvaney’s system.

But, as evidenced by his literally outstanding results versus peers, others do not do what Mulvaney does (and I put myself in this camp). Given most look up to Mulvaney at the moment, the question becomes - Why don’t others do what Mulvaney does?

As I ponder this, a few quotes come to mind.

The first quote comes from Richard Dennis in Market Wizards:

“I always say that you could publish trading rules in the newspaper and no one would follow them. The key is consistency and discipline.”

It took around 20 years for Mulvaney’s approach to really catch fire. Think about the level of commitment and faith he demonstrated. Moving along…

The second is a quote from Bill Eckhardt in The New Market Wizards:

“…it’s much easier to learn what you should do in trading than to do it.”

Amen, Bill, amen.

The final quote comes from Stan Druckenmiller in Soros’s biography:

Druckenmiller pointed out many traits that gave Soros a competitive advantage: the ability to compartmentalize, intelligence, coolness under pressure, insight, a critical and analytical mind. But repeatedly he kept returning to Soros’s brilliance in “pulling the trigger.” This, Druckenmiller said, provided the critical difference. Soros himself uses the term, saying it was what primarily distinguished him from Rogers while they worked together. “Pulling the trigger,” said Druckenmiller, “is not about analysis; it’s not about predicting trends—it’s really about a sort of courage. It’s hard to describe. You know, the ugly way to describe it would be ‘balls.’ To be willing at the right moment in time to put it all on the line. That is not something, in my opinion, that [can] be learned. It is totally intuitive, and it is an art, not in any way a science.”

Interestingly, several people that were close to Richard Dennis talked about his ability to pull the trigger as well. But that’s a post for another day. Also, I do believe pulling the trigger applies to trading systems as much as discretionary trading. In theory trading systems make it easier to pull the trigger - in theory! Back to the point…

Now let me be clear, I’m not saying other traders don’t have balls. Different traders have different goals which translate to different systems and different risk tolerances and related leverage ratios. For example, funds managing institutional capital almost certainly cannot trade like Mulvaney as the resultant drawdowns would have institutional investors running for the hills.

That said, I think there is a huge trading lesson in the reality that we admire and envy Mulvaney (right now at least) and arguably could replicate his approach but we don’t.

If nothing else, consider this the next time someone tells you that anyone can run a simple trading system if they have the rules.

Food for thought.

If you’re interested, here is a link to Mulvaney’s website: mulvaneycapital.com/

Note that I do not know Mulvaney and have no financial incentive to write this post.

Great article, George. So spot on with traders not being able to execute extremely simple concepts due to so many things they allow to get into the way. Lack of discipline. Inability to "pull the trigger". Not taking the time each day to run their process. Not having backups. Not taking the time to put together a complete trading strategy with buy/sell engines, position sizing, risk management and concepts for taking profits. Not understanding themselves well enough to be aware of where their weaknesses are and working on getting better at the process of trading. Instead, it seems many spend their days watching their X feed and making predictions on where "XYZ" will be next week, which is not the pathway to producing profits over the long-run.

Impressive numbers. In the friendliest way possible, small typo - "That is not something, in my opinion, that [can] he learned."