Yesterday, I read an article from Gary Antonacci of Dual Momentum Investing fame. The article was not bad but one paragraph in particular really got my attention:

Even with top performing mutual funds, investors can be their own worst enemies and find ways to underperform. Fidelity’s Magellan [fund] had an average annual return of 29% and was the best-performing mutual fund from 1977 to 1990. During that same period, the average investor in that fund lost 9% according to Fidelity.

Not that I doubted Antonacci, but I did a little research to confirm his comments above and indeed found support for his claim. Per Google’s Search Labs AI Overview:

Yes, it's true that while the Fidelity Magellan Fund, managed by Peter Lynch, achieved impressive average annual returns, the average investor in the fund actually lost money during his tenure. This seemingly paradoxical situation arose due to investors' tendency to buy high after good performance and sell low after poor performance, a behavior known as "recency bias" or "action bias".

I call the phenomenon described above “The Chase” hence the name of this article.

When you talk to wealth management guys, they mostly tell you that the biggest value they add to their clients as it relates to investments is trying their best to get people to stick to a plan. But the thing is, most people can’t stick to a plan. When a crisis like 2008 comes, many angrily fire their “guy” (financial advisor) in favor of walking across the street to a new “guy” in hopes this new guy will right the wrongs of the last guy. Ironically, most of these advisors are doing more or less identical things in terms of investments so the whole exercise becomes a bit like a game of musical chairs.

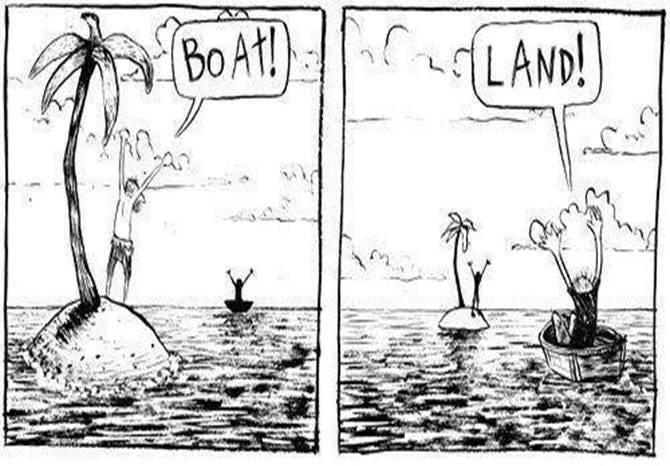

I sometimes mentally envision these frustrated clients passing each other on the street on their way to each other’s respective former advisor in search of salvation which brings to mind one of my favorite cartoons:

Via my digital version of a splintered soap box (Substack), I have written/preached about an alternative to buy and hold that utilizes trader principles to produce a more stable outcome that people can stick with. When I set out on the path, I figured people would be happy to have an alternative that produced good returns while allowing them to sleep at night since, over the years, I noticed this is/was indeed a consistent and persistent problem among investors. Along the way, I have learned that my original concept doesn’t work for most people.

Despite the reality that my strategies tend to end at about the same place as buy and hold but with a lot less volatility and a lot less drawdown doesn’t matter. When my approach underperforms, people get nervous and some quit in favor of the performance chase.

In light of this, I have recently been thinking that it might make sense to focus more on outsized returns; if I put up performance numbers that were undeniably good, people would have no choice but to come to the tent. But better performance numbers almost always come with more volatility and history demonstrates that people cannot keep the faith in times of volatility. The Fidelity results amply demonstrate the point - despite the fund making 29% on average per year, most people lost money because they chased the big wins and abandoned ship on the losses - they couldn’t stick with it.

As it relates to investing, over time I’ve found that most people are best served to be exactly aligned with their neighbors. Said another way, if the neighbor is down 50% and you are down 25%, that’s nothing to celebrate because you’re still down 25%. Meanwhile, if the neighbor is up 50% and you’re only up 25%, forget it you’re not keeping up with the Joneses and ire ensues. And if you’re up 50% while your neighbor is up 25%. you’re king of the hill. But when you’re down 50% while the neighbor is down only 25%, you cannot stomach it so you abandon ship and miss the subsequent outperformance. In theory, the solution is to find a way to always beat the neighbor on the upside while never taking any losses - but, outside of RenTec, I see no evidence of that being possible for the masses.

In fairness, over time, I do believe that good products find their audience. But, per my research, it is not uncommon for it to take money managers around a decade to reach critical mass. That’s a long time to spend struggling.

So, what’s the point?

I cannot say that there is one clear point with this article but I do have a few takeaways depending on audience.

If you are a retail investor, you might consider all of the above and, in conjunction of an exploration of your temperament and your goals, pick an approach that you can stick with and stick with it so you don’t turn a 29% annual return into -9% via performance chasing or other meddling.

If you are a money manager, I have two thoughts:

First, the above material reflects realities I see and can inform your journey or provide you with potential comfort depending on which camp you live in.

Second, if you want to follow the path of least resistance, keep the whole idea of aligning with the neighbor in mind in conjunction with the reality that most people don’t really want to know themselves. If you marry that with the fact that most people want the shortest answer that makes them feel like everything is going to be ok you’re moving toward the path of least resistance. The undeniable champion of sales tools when it comes to investing for the masses is a chart of the S&P 500 over the past 100 years with a bunch of pictures of why it should have gone down (COVID, financial crisis, 9/11, etc.) but did not. Of course, almost no one can handle that ride, but if you go with that approach, you can likely bet that when your clients quit to go to the next advisor, his or her clients will also have quit and will probably come to you.

For sure I'm always snatching defeat from the jaws of victory and I have real issues sticking to plans. I've tried harder this year, I really have and it has gone slightly better. On neighbours, (literally not figuratively) I moved somewhere where I'm more near the top of the pile than the bottom and it has been helping psychologically I think. 😅