AI's Dominance in Markets

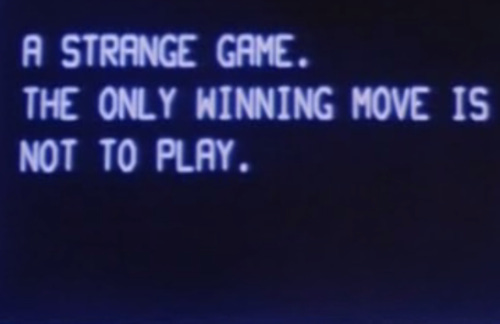

Image source: War Games (1983)

More than once in recent months I have been asked for my opinion on the role that AI will play in trading, investing, and markets in the future so I decided to write this post. I believe people are asking me mostly because they wonder if AI is going to replace all humans in markets by achieving superhuman results. My short answer is that I do not think AI will take over but I will expand on why in detail in this post. Unfortunately for you, dear reader, the journey requires a bit of knowledge of statistics and quantitative trading; I will do my best to keep it layman friendly.

Quantitative trading strategies rely on statistics to draw conclusions from research efforts. These statistics include metrics like average return, standard deviation of returns (aka volatility), and more. The key point here is that you cannot be a quant without data and statistics. I will come back to this.

Generally speaking, statistics rely on “samples” that are used to approximate a “population”. As a day-to-day example, a national restaurant chain with 10,000 locations might decide to test a new product to see if it is a hit. Ideally, the company would test the product in all locations (aka the “population”) as that would provide a true test of the product’s efficacy. But testing on every store is typically not cost effective so the company would likely decide to test a product out on maybe 100 locations (the “sample”). If the product bombs on the sample, it does not get a wide rollout. Comparatively, if the product succeeds “in sample”, it goes live everywhere. Generally, over time, if done correctly, this sample-to-population approach has been proven effective. Regardless, my point here is simply to teach a little bit about how the relationship between sample and population works with a layman friendly example.

As it relates to statistics in markets, quants will look at historical data (“sample”) and use it to make inferences about the future (“population”). Technically, the “population” here would be past and future but the point to take away here is that, with markets and quant trading, traders are using the past to approximate the future and are making the implicit assumption that the future will look enough like the past to turn a profit.

Let’s shift gears a bit and talk about the use of statistics in the casino game blackjack (aka 21). While the rules can vary (multiple decks, continuous shuffle, etc.) for certain sets of rules, if you keep an active tally on the cards that have already been “played” you can calculate probabilities based on what remains in the deck and this can put the odds in your favor. This reality relates to something called “path dependency” which basically means that things that have come before impact what comes after.

If you find this confusing, take a deck of cards, face down, and slowly flip them over one at a time organizing them by number or face (i.e. put 4s with 4s or Jacks with Jacks). As you get closer to the end of the deck, you will almost certainly know exactly what remains face down since you will only see three Jacks (or 8s, or Aces, etc.) face up. Now imagine if you could bet on what remains in the deck toward the end of this exercise.

With “path dependent” games what has come before influences what comes after and, the closer you get to the end of the game (run out of cards), the more you know about what remains. You cannot know what remains with true accuracy until the very end, but, as play progresses, you can gain a statistical edge by calculating your odds. And, if you play long enough and adjust your play to reflect when the odds are in your favor, you can walk away net profitable. So how about markets?

Markets are different from games like blackjack because markets change over time. To use the term above, markets technically are not path dependent. You can indeed look back at market history (“sample”) and use statistics to determine strategies that worked well in the past but there is no guarantee that these same patterns will work the same in the future (“population”). No matter how much you try to convince yourself with mounds of data or “robust” studies, the only thing that will tell you if you’re right in markets is time.

I can sense your eyes glazing over, but stay with me.

If you study great quantitative traders and run a lot of systems on your own, patterns emerge. Most quants start out thinking that they are invincible because they have data and statistics only to find out the hard way how markets really work. If you’ve ever found a stock that always goes up on the 10th day after 9 down days and you decided to buy on the 10th day only to watch the stock fall on day 10 and 11 and 12 and…you know exactly what I mean. Now let me introduce you to one more concept related to quant trading, optimization.

In quant trading there is something called “optimization” which is defined as the process of fine tuning a quant system to (hopefully) allow it to achieve the best results in the future. There is a related term, over optimization, which, in general terms, indicates that something has been optimized too much. However, if you ask 1,000 quants where the line lives between properly and overly optimized, you will likely get 1,000 different answers. Hindsight is the only thing that will truly tell you if something was or was not over optimized.

Despite this annoying reality, there are certain truths that are very consistent among quant traders. For example, as any quant who has been in the trenches will tell you, highly optimized trading strategies (those that work exceptionally well in the rear view) almost always fall apart in real time. And, while no group of quant traders will agree on the exact line when something goes from properly to overly optimized, in my experience, they will all know when something is egregiously over optimized (the telltale sign is a simulation that produces results unlike anything that exists in reality).

Generally, the longer someone works as a quant, the more obsessed they become with ensuring “robustness” which is to say they want to make sure they are as far from over optimization as possible. And this is the case for three primary reasons:

They know from experience how sample versus population works in markets (see above)

They know from experience that markets are not path dependent (see above)

They know from experience that over optimization always ends bad (see above)

So how does all of this relate to AI?

AI would have to use data and statistics to draw conclusions thus AI trading or investing would be quant trading or investing. As such, over enough iterations, I find it hard to believe that AI would wind up reaching a conclusion that is different from the conclusions reached by generations of battle weary quant traders because the three realities outlined above are, in fact, realities.

You might wonder if AI could try to find some combination of variables that enabled it to identify when the time was “right” for a given strategy then taking huge risk to achieve outlier results to which I would say my research on decades worth of quants has not found anyone who goes that route successfully. Usually quants wind up with some kind of “shades of grey” approach where they opt not to get too far left or right of center for fear of blowing up (often after having blown up). And quants avoid what some call “multiple comparisons” (aka stacking variables to find the perfect environment) because this ventures too far toward the universally agreed upon I’ll-know-it-when-I-see-it money losing land of over optimization.

Ok, what about AI trying to emulate a great discretionary trader?

By virtue of reading and co-authoring the Market Wizard series, I have been lucky to get to know a lot of amazing discretionary traders with exceptional results. Using information available in the books, I sometimes attempt to take a given discretionary trader’s logic and systematize it to the extent that it can be systematized. Generally, I find that systems based on a given discretionary trader’s approach in their best years tend to do really well in those same years. However, when I extend these same systems out over 5 or 10 or 20 years, the average results are often not very compelling to the point that these systems don’t deserve to be traded. This is probably worth another post another day but not here or now.

At the risk of repetition, in the end, if AI is worth a darn, I’m guessing it will reach the conclusions of decades worth of great quants by virtue of analysis or experience. In my opinion, AI will land on one of two outcomes:

AI will build some kind of massively diversified system that will probably have reasonably strong reward-to-risk statistics but that will not achieve financial alchemy and thus won’t knock anyone’s stocks off.

AI will adopt a philosophy not unlike that of the computer, Joshua, from 1983’s War Games which found that the only reasonable way to win the “global thermonuclear war” game was not to play. In other words, if tasked with dominating all other traders I think AI might reach a conclusion not to play because the only way to potentially achieve that goal would be to take risk that inevitably leads to wipe out and wipe out would mean game over.

So there you have it, my take on AI’s long-term role in the markets. Am I right? Time will tell.

Few additional points.

First, thus far in my experience, AI is wrong a whole lot and on very basic things. For example, one LLM told me it was creating a 15 stock portfolio and only provided 14 stocks meaning the bot couldn’t count to 15. AI probably needs to learn to do very basic math before it becomes any kind of threat to humans.

Second, a human could “seed” AI with a specific goal (ex. achieve the highest return possible even if it means wiping out an account) and such an AI-driven system could really produce some jaw dropping results…for a while. But, per all of my quant studies, too much risk with robust quant eventually leads to wipe out and over optimized systems usually go terrible even with small risk.

Third, discretionary traders using AI as a tool in their larger toolkit is another story for another day.

Waiting for your take on discretionary traders using AI as support tool. Can't wait to hear from you

I saw this one day, not sure of the inputs but the results are nothing special. https://nof1.ai/leaderboard